The Qt Company - Qt Group Oyj

A relatively unknown global SaaS company with low international ownership.

Kde mascot Konqi

History

Qt Group (NASDAQ : QTCOM) is the company behind the popular Qt framework.

The Qt framework is probably best known for being the framework that the KDE graphical desktop enviroment is based on. KDE is the default desktop enviroment used in popular linux distributions Kubuntu, openSUSE and KDE Neon.

The QT company was founded in september 2014. It has core R&D in Oslo, Norway as well as large engineering teams in Berlin, Germany and Oulu Finland. But the origins of the Qt company go all the way back to 1991. Erik Chambe-eng and Haavard Nord started writing Qt in 1991 and on the 4th of March 1994 they founded their own company; Trolltech. Trolltech completed an IPO on the Oslo Stock Exchange in July, 2006. On the 28th of January 2008, Nokia Corporation made a tender offer to aqquire Trolltech. The total cost for Nokia was approximately €104 million. By June 17th 2008 Nokia had completeed its acqusition of Trolltech. On the 30th september 2008 Trolltech was aptly renamed as Qt Software. Nokia sold the commercial licensing business of Qt to Digia in March 2011. The remainder of the assets were subsequently aqqired by Digia in 2012. In September 2014, Digia formed The Qt Company, a wholly owned subsidiary dedicated to the developement and governance of the Qt platform. In May 2016 the company went public on NASDAQ Helsinki as QTCOM.

Both the share price and the revenues of the QT company have been growing rapidly. As evident by the following chart, the QT company has seen little meaningful multiple expansion since it’s IPO as it’s revenue growth has kept up with the share price appreaciation.

The Product

“Qt’s products based on Qt technology, are used for developing efficient, interactive and multi-platform interfaces and applications. These can range from in-vehicle infotainment systems to in-flight entertainment systems, printer touchscreens or industrial robots.

Qt is uniquely positioned to benefit from the rise of Internet of Things (IoT). As more and more objects become connected, the demand for embedded systems is set to grow. And with connections come new user interfaces and ways of adding value to the end-user.

Qt technology is used used by over a million programmers globally, and in over 70 different industries, millions of devices and applications – such as consumer electronics, vehicles, airplanes and industrial automation applications.

Qt software development tools are built using open source code, which means that they can be licensed under both commercial and open source licenses. Our large open source developer community plays an important part in the development of Qt technology, and supports our research and product development unit.”-Qt.io

For C++ programmers. Qt has no rival. C++ is used for the backend, while QML (QtQucik 2) is the frontend. This results in fast applications ideal for embedded devices.

Some of the most well known applications using Qt:

Ableton Live, Adobe Photoshop Elements, Autodesk Maya/3ds Max, CryEngine V editor, DaVinci resolve, Google Earth, Roblox Studio, Source 2, Telegram, VLC media player, WPS Office

Organizations using QT include:

Blizzard Entertainment, Bmw, Daimler AG, DreamWorks, Danaher, Huawei, LG, Microsoft, Panasonic, Phillips, Samsung, Siemens, Tesla, Tomtom, Volvo, HP, Walt Disney, Walve.

One of the main benefits of Qt is its ability to run on many different platforms. It runs on basically any system based on Linux, Windows, iOS, macOS, Android. It even runs on embedded systems such as Integrity, QNX and VxWorks. Allowing developers to more or less build once, deploy everywhere. This also means that learning Qt is an extremely valuable and transferrable skill, as its usage is very wide.

The Business Model

It’s mainly a licensing model. Qt sells bundles Design & Develop starting at $4490 pr user pr year. As well as monthly licenses starting at $233 pr year.

On top of this Qt also operates the Qt Marketplace which sells Qt extensions, trainings merchandise and more.

The pros:

Highly stable subscription based revenues. Churn is very low as virtually all developers use an agile developement framework apps already developed with Qt will need constant updating practically eliminating churn during the full lifecycle of an app.

Next major project revision; QT 6 was just released. The last major revision to Qt was QT 5 back in 2013. Customer on QT5 will need to upgrade to QT6 which is sold on a new subscription based model.

Cross platform Build once, deploy anywhere.

Uniquely positioned As an enterprise ready front end for C++ applications, Qt really has no credible rival.

Diversified Focus across industries. “The Group’s business development efforts will focus on desktop applications as well as embedded systems in the automotive industry, consumer electronics, medical devices, and industrial automation sectors.”

Profitable.

The cons:

Competitive field Other cross platform application frameworks exist. Such as Microsoft .net framework, or Facebooks React framework. These are however not compatible with C++ so they are not directly competing.

Cross platform Cross platform interfaces are inherently somewhat akin to swizz army knives. They wont provide as smooth an experience as native development frameworks.

C++ While it is being widely in the industry used it is not known as being an easy langauge to learn.

Reliance on consulting and maintenance revenue Because licence sales are lumped together with consulting sales in the quarterly report, it is impossible to discern how reliant Qt is on consulting revenues which are lower margin.

Valuation and growth

Qt Group is projected by analysts to grow its revenues by 27.73% in FY 2021. And 26.91% in FY 2022.

With a market cap of around 1.69B euros, or just about 2B dollars. It goes squarely in the small cap software segment.

It has a Market cap of €1.69B

Analyst estimates (from Koyfin):

2021e: €84.34m 20x sales (27.73% growth)

2022e: €107.04m 15.79x sales (26.91% growth)

Authors estimates:

Note that these are just guesses, it would not surprise me at all if the actual numbers came in signficantly higher as IOT takes off. I have tried to keep the revenue targets conservative.

Chart and estimates courtesy of @ArimattiA

Bear market case:

5x sales in 2025

1.475B valuation.

Base case:

20x sales in 2025

€5.9B valuation

Blue sky (bubble) scenario:

50x sales in 2025:

€14.75B valuation

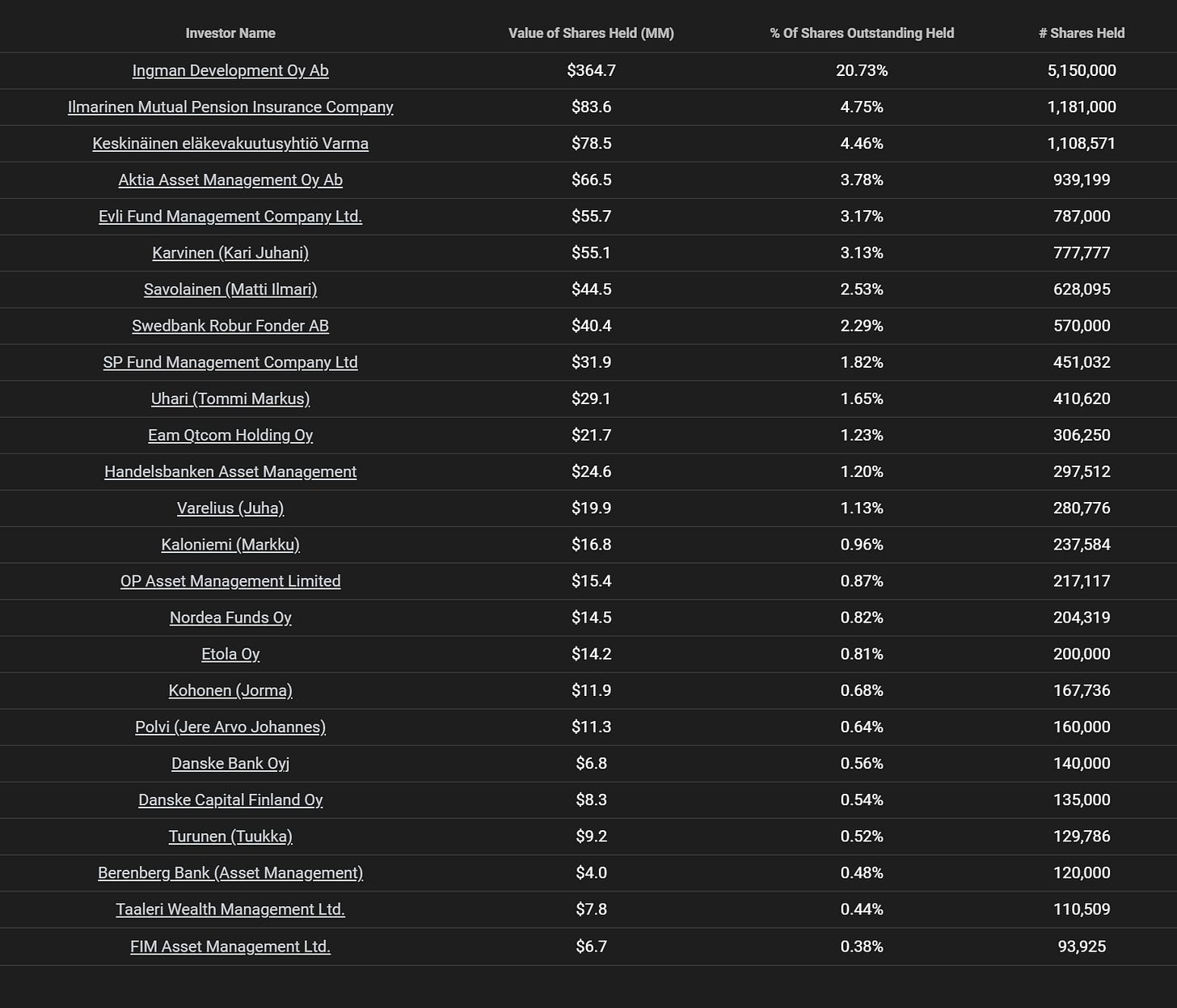

A hidden driver of potential upside - Almost no international ownership

Qt Group is mostly held by Finnish investment funds. It is thus easy to conclude that this stock is severely underowned by global asset managers. A higher international ownership could mean a re-rating of the stock.

Source - Tikr.com

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk, and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their research before executing any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Disclosure

The author owns shares in Qt Group Oyj at the time of this blog post's publication.

The author has no business relationship with any company mentioned in this article, and the author is not receiving any form of compensation for this article.