Poshmark S-1 Quick Overview and Thoughts

Source: Poshmark S-1

Intro

Poshmark (NASDAQ: POSH) is the leading social eCommerce marketplace App targeted at millennials and gen z in the US focusing on the buying and selling of second-hand fashion goods. Here are the top 3 reasons anyone should be interested in this company:

1,354,197 total app downloads in December of 2020 according to Apptopia

Younger generations are more positive towards using used clothes than earlier generations.

Founder led business

Source: 2020 Fashion Resale Market and Trend Report | thredUP

Summary

Poshmark is a social marketplace platform.

I think of Poshmark as eBay meets Instagram.

It is built up as a social network where users follow each other. Users can then share their listings to make them show up on their followers' feeds, incentivizing activity and forcing sellers to keep visiting the app to re-share their listings, unlike eBay, where listings only need to be shared once until they expire. Listing on Poshmark is very simple, and one of Poshmark's key ways that they differentiate themselves from eBay is by making the listing process as frictionless as possible.

The idea is that the shopping experience is trying to capture authentic human connections in an eCommerce format. Poshmark is gamifying eCommerce by turning it into a game of followers, likes, and shares. Poshmark claims that this will drive a flywheel resulting in repeat purchases, social feedback, and long-term engagement.

There is a Stitch Fix (NASDAQ: SFIX) element to it as well as buyers can get personalized experiences with sellers who understand their individual style, sizing, and fit. Sellers often send handwritten notes to buyers along with their items.

Second-hand items are, as expected, a great value compared to retail items, where especially luxury goods can be found at much lower prices despite often being nearly as good as new. There is an Environmental, Social, and Corporate Governance (ESG) element to it as well, as the buying and selling of used goods support the environment.

The Poshmark IPO spotlights the reCommerce space, which has other high-profile companies such as The RealReal (NYSE: $REAL) and ThredUP (Private). The pandemic has notably set off something of a reCommerce boom. According to a thredUP report [B1] released in late 2020, the resale market grew 25 times faster in 2020 than the overall retail market did in 2019.

Note: Recommerce or reverse commerce is the selling of previously owned, new, or used products, mainly electronic devices, or media such as books, through physical or online distribution channels to buyers who repair, if necessary, then reuse, recycle, or resell them.

[B1]thredUP report

Poshmark allows sellers to run a full-scale shop from their mobile phones. As of September 30, 2020, sellers on average had 359 followers, and the most followed seller had more than 2.7 million. Sellers are encouraged to create a personal brand and have ongoing relationships with buyers. The social feedback helps with keeping the sellers engaged. Poshmark allows seller's market their items through social tools without spending any money on marketing to drive traffic to their listings. 87% of items purchases were preceded by a like, comment, or offer. Poshmark claims to have 30 million active users who spend 27 minutes on average daily on their marketplace.

Poshmark's pricing model is:

· either taking a flat 20% fee based on the final sale price of an item for sales $15 and over, or

· earning a flat rate of $2.95 for sales under $15, thus incentivizing sales above $15.

Story

Poshmark was founded in December of 2011 by the team of Manish Chandra (CEO), Gautam Golwala (CTO), Chetan Pungaliya (SVP Engineering) and Tracy Sun (SVP New Markets) in Fremont California.

Manish Chandra grew up in India in Old Delhi. His mission with Poshmark was to put the social part of shopping back in eCommerce and recreate a community centered around the shopping experience. Poshmark was built as a response to Chandra seeing the rapid growth of the iPhone 4. The rise of mobile allowed him to create a platform that would enable every iPhone user to make money selling their style, only by using their phone, giving a second life to millions of items. In his own words:

As an engineer, I approached the challenge of reimagining retail's developing a blueprint. It centered on three must-haves: 1) social, to make shopping fun and human again, 2) sustainable, both socially and environmentally, and 3) data- and technology-driven, to make it simple and easy for anyone to discover, shop, buy, and sell.

Growth Strategy

Growing active users. The more users the more powerful the network effects.

Adding new product categories, currently Poshmark is mainly used for clothing and jewelry.

International expansion. Poshmark started in the US and expanded into Canada in 2019. More countries are expected to follow.

Continued investment in their marketplace to attract professional sellers, brands and retailers.

The numbers

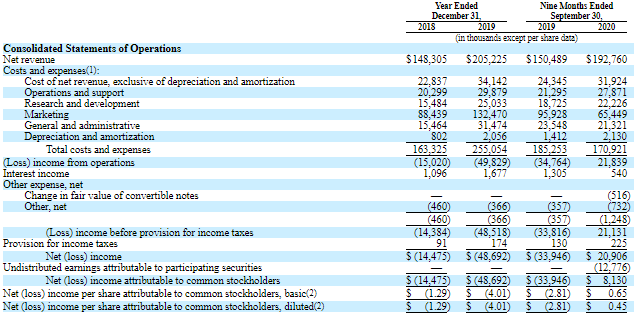

Source: Poshmark S-1

After losing $14.5 million in 2018 and $48.7 million in 2019, Poshmark made $21.1 million in the June 30 quarter and $10.7 million in the September 30 quarter.

Growth rates:

Based on the above Consolidated Statement of Operations taken from the S-1. I calculated Poshmark's historical growth rates to be as follows:

FY 2019 38% revenue growth

FY 2020 28% revenue growth

Valuation:

$6.08B market cap / $247.5m revenue = 24,5 p/s (TTM data)

83.2 / 0.65 = 184,8 P/E ratio (9 month data)

Competitors:

*all data based on the most recent quarter, market data from 15/01/2021 closing prices.

How it works:

The Poshmark flywheel consists of two elements: Demand and Supply.

1. Demand, buyers interact with sellers through comments, follows, likes, and shares. Buyers are encouraged to be activated as sellers by ques inside the app.

2. Supply, where the sellers are incentivized to share their listings daily to get a higher ranking on the platform, encouraging them to keep returning to the app even when they are not just listing an item. Poshmark believes it will increase the likelihood of them also become activated as buyers.

Source: Poshmark S-1

The Poshmark userbase is heavily tilted towards millennials and Gen Z.

Source: Poshmark S-1

GMV - Gross Merchandise Value breakdown

Most of the good sold on Poshmark are second-hand goods in the fashion category below $50

Source: Poshmark S-1

Quantitative Data

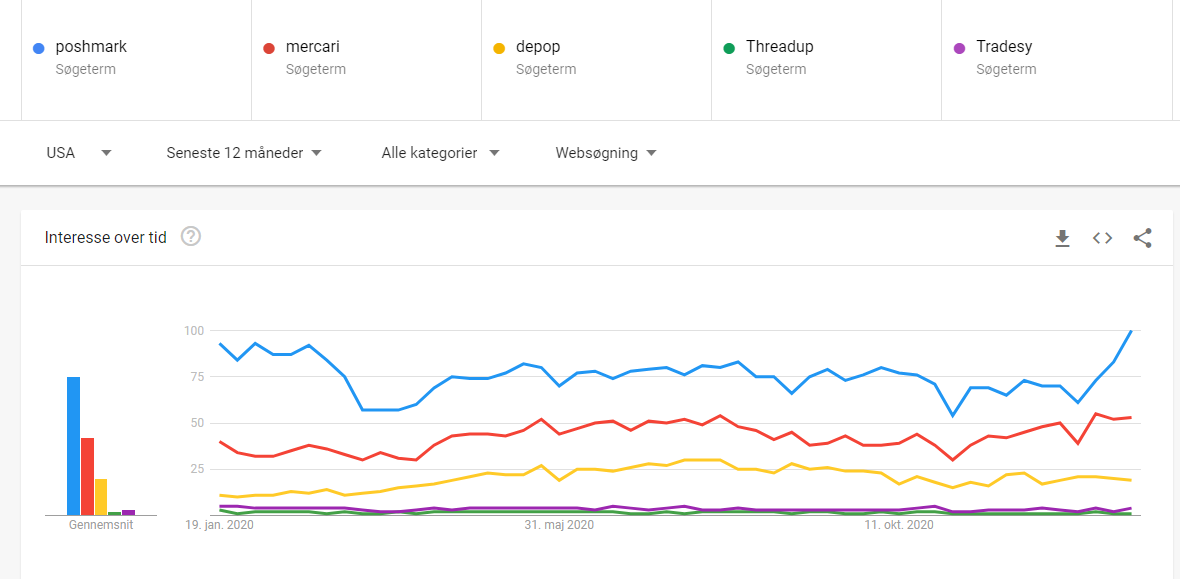

2021 Google Search Trends:

Poshmark is number one in its category. The spike in search traffic in the Christmas quarter is likely a mix of the IPO and normal seasonality associated with eCommerce. Q4 is always the strongest quarter for eCommerce because Christmas shopping being a significant driver.

Source: Google Trends as of 16/01/2021

App Store Intelligence

App store intelligence is one of the best alternative data sources. The following chart is courtesy of Sensortower as pr. the 17/01/2021 and shows Apple app store rankings for the shopping category. It is encouraging to see Poshmark rank above Etsy and Mercari in terms of downloads.

Source: Sensortower.com - Top Charts: iPhone - US - Shopping

Since the App Store data does not tell the full story around the engagement Poshmark platform is getting. I have included a graph showing website visits to the main Poshmark.com website. Numbers look like they are trending up steadily.

Source : Poshmark.com Analytics - Market Share Data & Ranking | SimilarWeb | 19/01/2021

Conclusion

This section reflects my perspective, and I could be wrong about it. Still, I suspect Poshmark will do reasonably well as a public company if it can continue innovating and grow its userbase.

In the next 12 months, it will be interesting to see how well Poshmark navigates the ongoing Covid-19 crisis and whether they will have a smooth transition from a private to a public company.

Valuation on a price to sales basis seems excessive as of writing when compared to their closest competitors REAL and Mercari trading at a 132% premium to Mercari and a 220% premium to "The RealReal." It could be a significant near-term risk for buyers near today's share price of 83.20. It needs to be mentioned that take rates are very high for Poshmark. The RealReal has a high take rate of 36%, but since It pays the cost of authenticating, merchandising, shipping, and accepting returns for all the items it sells, its costs are also much higher than Poshmark. So it could be argued that Poshmarks low asset model and high EBITDA margins warrant a premium over peers.

Below I have broken up two lits of bullet points about what I like about $POSH and what I don't.

What I like

· Millennial / Gen Z focus. The true digital natives will be the cohort with the most purchasing power in the future.

· ESG angle - used goods coincide with a more sustainable lifestyle. 16% of gen z have second-hand goods in their wardrobe vs. 10% for baby boomers.

· 600k app downloads despite being only in the US and Canada, Etsy, for comparison, has 800k worldwide.

· Healthy engagement rate, the average user spends 27 minutes on the platform.

· Social aspect. Keeps users engaged.

· Long runway for growth. eCommerce penetration is still low.

· Potential for international expansion.

· Very high margins, a 20% cut is in the high end of social marketplaces.

· Asset light, Poshmark is purely a digital platform and carries no inventory. Buyers pay for shipping.

· Profitable.

· Founder led, tech-first business.

· Very high scores on blind 5.0 (perfect) /Glassdoor 4.8 (Recommend to friend 99%/Approve of CEO 99%) indicating a positive company culture.

· According to thredUP's annual report, the resale marketplace is currently worth roughly $28 billion and is projected to reach $64 billion by 2025.

· Large and active secondary communities around the platform on YouTube and Reddit (40k+ followers)

What I don't like

· Lots of direct competition in the space with Mercari, eBay, Depop, Threadup, Tradesy all competing in the US's second-hand fashion goods market.

· Slowing growth, 28% growth in the recent 9 month period down from 38% in 2019.

· It is not cheap trading at 24.5 trailing sales.

Thanks to Bogdan Ceobanu for reading the drafts of this article.

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk, and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their research before executing any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Disclosure

I own shares in Poshmark at the time of this blog post's publication.

The author has no business relationship with any company mentioned in this article, and the author is not receiving any form of compensation for this article.