Closing Thoughts For The Week - 6

The more things change, the more they stay the same.

The following write-up reflects only the authors opinions and should not be taken as investment advice. The piece is solely meant to be read for it’s entertainment value. The author may own, buy and sell equities mentioned in this post.

Market

Not much changed in the past week on a market wide level. A slight pullback across the board.

The US 10y yield has now risen to 1.71% which equates to a 87.88% move YTD. Causing longer duration higher risk assets to continue their streak of underperformance.

Value stocks have stayed more or less flat in the past week, and may have reached at least a near term limit.

As the rates have been climbing, so has the estimates for bank earnings. In short this is because that when interest rates are higher, banks make more money, by taking advantage of the difference between the interest banks pay to customers and the interest the bank can earn by investing.

SaaS earnings

Crowdstrike delivered a great earnings report and an even better guidance. The market initially credited the good report with an after hours rally of around 8%. Yet the stock still managed to end the week flat, indicating that the good news had either been priced in, or not been good enough to offset the rise in interest rates.

Coupa had a strong beat, but delivered not-so great guidance. The stock sold off 8%, it’s multiple is still quite high at 28.14x forward sales.

Crowdstrike trades at a similar premium. at 32.15x forward sales. However, due to Crowdstrike always trading at a premium as a public company, this is not much higher than it’s mean forward multiple of 27.40x, and actually below where it traded immediatetely after going public. Crowdstrike is a different company now than it was in 2019, expected forward revenue growth on a percentage basis is less, but it’s ebitda margins are also significantly higher.

IPOs

Digitalocean is going public and will have the ticker $DOCN

From Digitaloceans ipo roadshow they have been showing good progress on their adj. FCF margins. And they expect to be able to generate FCF within a year. The company is not growing very fast compared to the general IaaS landscape at 25%, It’s competing with $MSFT Azure and $AMZN AWS while growing slower from a much smaller base. All in all not all that compelling on paper. However, the valuation at 15.7x ttm sales could mean that this could still be a great stock if they manage to acellerate growth and move towards a positive FCF. It’s definately worth watching. tttt

$OLO

Olo is a company I took a position in immediatately after their IPO as I really like their business and leadership. I’m a very big believer in the digitalization of all parts of society and one of the largest industries in the world, the restaurant industry, has been lagging in that regard. Olo provides an independent white-label ordering platform allowing restaurants full control over their brand, and giving them leverage over 3P delivery platforms such as Doordash, Grubhub, Ubereats. etc. Think of Olo as the interface between restaurants and the on-demand world.

Restaurants use Olo to power the entire ordering process. From customer interfaces to restaurants. Orders are consolidated into Olo’s cloud platform no matter the origin, Mobile, Web or “Whatever comes next, think voice assistants” Olo provides a dashboard allowing restaurants to track order information and sales, make changes to their menu and generate reports.

Dispatch

Dispatch is a module for Olo where delivery bids are submitted in real time and customers are matched with the best available courier based on the restaurants delivery rules. This process happens in realtime, for every order. It allows restaurants to own the customer relationship as well as the data associated with those orders. Instead of ceding both to the 3P delivery platforms.

Another aspect that really made me interested in Olo was their very Low S&M spend compared to most other SaaS names. The valuation very high, as is typical for SaaS ipo’s. But considering Olo’s best in class metrics, and very large TAM I think it could have a good upside still. A key risk is reopening, as the growthrates experienced during the global pandemic wont be repeatable. Olo grew their revenues 59.4% from 2018 to 2019, indicating that the company’s growth was not a result of the pandemic but merely accellerated by it. I hope to see growth in the 40-50% range from here, otherwise I will have to reevaluate my thesis.

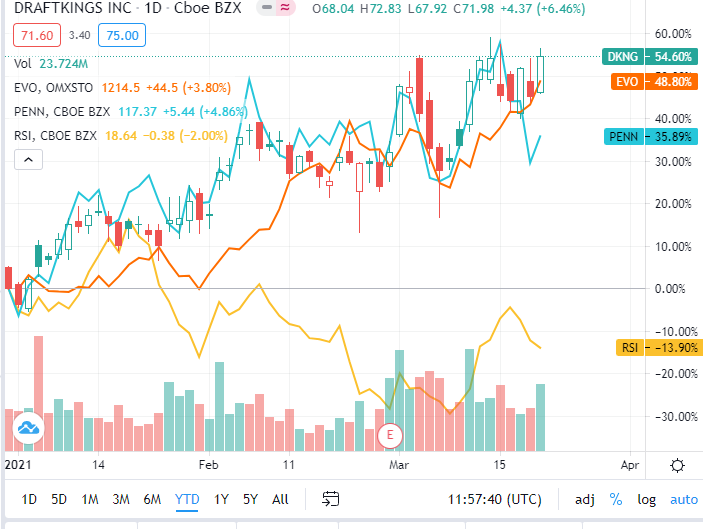

Gambling stocks.

Just to close out I want to note that Gambling stocks have been on an absolute tear this year. Congrats to anyone that caught these strong uptrends.

That wraps up my closing thoughts for the week. Hope you enjoyed reading. See you next week!

Disclosure

The author owns shares in Okta, MongoDB, Twilio, Sea Ltd, Crowdstrike, Unity Software, Olo and Cloudflare at the time of this blog post's publication.