Closing Thoughts For The Week - 5

The following write-up reflects only the authors opinions and should not be taken as investment advice. The piece is solely meant to be read for it’s entertainment value. Note, most of this post was written on wednesday before the massive crashes in the weed stocks had taken place. The author may own, buy and sell equities mentioned in this post.

Market

Since last week, the Nasdaq has recovered almost half it’s loss, while the SP500 is sitting at all time highs. Two recent ipo’s, $RBLX and $CPNG were very well recieved, pricing at the top of their ranges, followed by a large day one rally. Roblox ended it’s first day of trading up 64%. While Coupang ended it’s first day of trading up 40.7%. By all accounts two really successfull ipo’s indicating to me that the appetite for “work from home” tech names is still very high.

Outside of tech, reopening names continue seeing very strong bids. Some, like Caterpillar are riding on the coattalails of a multi trillion dollar infrastructure plan.

Digging deeper into Caterpillar inc. we can see that it tends to quadruple or triple off of cyclical bottoms. If I had to guess just based on it’s historical moves the rally in the stock could carry the stock into low the 300s, perhaps even higher. I like to remind readers that value stocks also can become overvalued, just as any other asset class.

SaaS

Together with the Nasdaq’s rebound we saw a very strong rally in SaaS names, centered around the most expensive high growth (>40%) cohort. This is unsurprising as these names had been hit the hardest in the selloff. They are still well below previous peaks, but it looks like the market has found an equillibrium for now.

Spacs

There are rumors going around touting that GRAB is in advanced talks to go public via Altimeter growth corp ($AGC) at a 40B dollar valuation. Grab grew it’s revenues 70% in 2020 and is seen as South East Asias second great tech company, after SEA limited. They are mainly in the businesses of ride hailing and food delivery, and recently received a digital banking license. Grab is thus building a super app in Sotuh East Asia, given the incredible success of Alibaba, Tencent and especially Meituan Dianping this company is sure to be on many tech investors lists.

Update: Merger talks between Grab and Gojek off the table, Garage - THE BUSINESS TIMES

IPO’s

$RBLX

Roblox is a really interesting company I have been following for a while. When the news of it’s IPO was first announced in late 2020, I wrote a twitter thread about it, explaining the investment case. Back then I viewed it as an incredibly exciting and well timed IPO. It was likely going public at a valuation around 8-10B. If it had began trading at that valuation, it would likely have doubled on IPO day and possibly begin trading at 20B. This is all hypothetical, but bear with me. A valuation of around 20B in December 2020 would have meant that there was still some immediate upside left for the general investing public. With a 2020 revenue of 923.9m after a massive year, boosted by tailwinds from the pandemic. Roblox would likely have been valued at 21.6x trailing sales on day one.

As we all know, this did not happen. Roblox management saw the massive hype that investors were drumming up around the IPO and pulled the plug so they could juice every last drop of the pandemic tailwinds, leaving not a single month of lockdown revenues to public investors. Roblox sold more shares on the private markets to hedge funds at a 29.5B valuation and then decided on a direct listing, as they had already bolsted their coffers with cash.

Essentially Roblox went “direct” while still raising money just months before, pretty much mirroring the traditional IPO process where funds get in at the ground floor while the public gets to buy in much higher.

With around 652m shares outstanding Roblox valuation at of today (12/03/2021) is 45.4B and it traded as high as 58.68B. That’s a multiple of 49x sales at the close and a ridiculous 63.5x sales at $90.

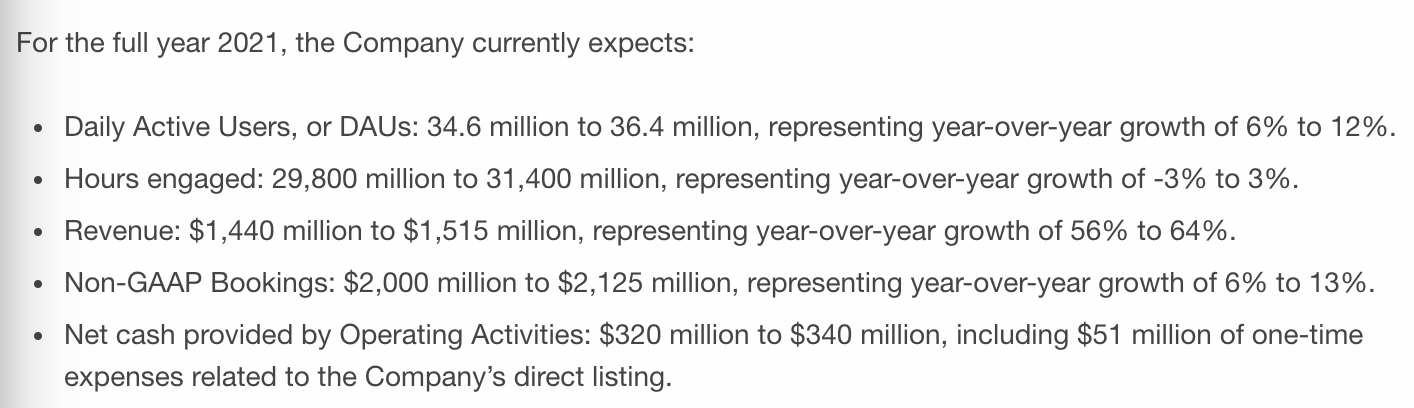

Before the IPO, Roblox quietly released guidance for 2021.

If we are generous and assume that they manage to land at the high point of their range at 1,515million that’s still forward revenue multiple of 30x. The problem here is that engagement is expected to be flat, and bookings are as well. So this is a 30x sales multiple for a company that will most likely be growing very slowly in 2022 and 2023. Roblox management is thus warning that the performance that the company saw during 2020 is by no means indicative of future performance. 2020 was an unusual year, were parents had been forced to stay at home with their children. I’m certain that children are going to continue playing Roblox, however, they are likely going to be playing it less than they did in 2020. Furthermore, Roblox has saturated their market in the west. I believe it is a safe assumption to make that almost anyone who wanted to make a Roblox account, has already done so, out of boredom.

That’s a lot of negative on Roblox. Positive growth drivers to look for:

Retention of users past the tween age.

More virtual events taking place.

Personally, due to the high valuation and expected post pandemic slowdown. I am waiting for the dust to settle before taking a long position in Roblox (or Coupang). Either the valuation have to drop, I think 30B is reasonable, but still quite high. Or the company has to grow into it’s current valuation by trading sideways. Either scenario is in my eyes, very likely, and I don’t think there is any reason to rush into Roblox right now.

That wraps up my closing thoughts for the week. Hope you enjoyed reading. See you next week!

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk, and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their research before executing any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Disclosure

The author owns shares in Okta, MongoDB, Twilio, Sea Ltd, Unity Software and Cloudflare at the time of this blog post's publication.